融e邦:平行进口汽车供应商“Cheetah Net”更新招股书,拟于纳斯达克IPO上市

牵手融e邦,资本运作很简单;平行进口汽车供应商Cheetah Net Supply Chain Service Inc.(以下简称“Cheetah Net”)在美国证监会(SEC)提交更新的招股书,拟于美国纳斯达克IPO上市,股票代码CTNT。 其早于2022年12月16日在SEC秘密递表。

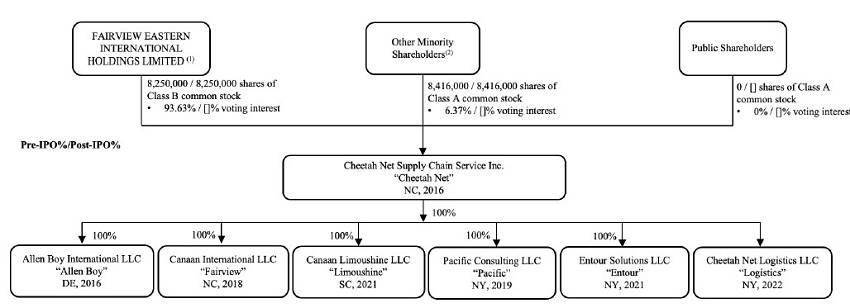

公司结构:

下图显示了截至本招股说明书发布之日以及首次公开募股(“IPO”)完成后,基于拟议数量[●] 发行的A类普通股,假设承销商没有行使超额配售选择权。有关我们公司历史的更多详细信息,请参阅“企业历史和结构”

商业概述:

我们是来源于美国的平行进口汽车供应商,将在中国市场销售。在中国,平行进口汽车是指经销商直接从海外市场购买,并通过品牌制造商官方分销系统以外的渠道进口销售的汽车。据我们所知,目前没有任何美国联邦或州的贸易或出口法律、法规或规则禁止将平行进口到外国的车辆出口。尽管如此,制造商及其经销商有时会将平行进口汽车视为其特许经销商网络的竞争对手,因此可能会采取措施限制或减少第三方(如平行进口汽车经销商)通过利用制造商在世界各地的不同定价策略获利的机会。例如,他们可能会在销售协议中增加限制所购买汽车出口的条款,或者他们可能会建立和更新可疑客户数据库,并监控和限制向这些可疑客户销售汽车。在中国,平行进口汽车的销售受益于中国政府自2016年以来颁布的一系列相关法规和政策,包括《关于推进汽车平行进口试点的若干意见》、《关于进一步促进汽车平行进口发展的意见》和《关于振兴汽车流通和促进汽车消费若干措施的通知》。这些法规和政策符合美国贸易和出口法。请参阅“-我们的行业和商业模式”。我们从美国市场购买汽车,主要是梅赛德斯、宝马、保时捷、雷克萨斯和宾利等豪华品牌,并将其转售给我们的客户,包括美国和中国的平行进口汽车经销商。我们的利润主要来自平行进口汽车的买卖价格之间的差价。

我们行业的主要驱动力是中国富裕群体的持续增长。我们业务的核心是能够识别需求量大的平行进口车辆类型,并及时采购。自2016年成立以来,我们的管理层一直专注于建立我们的采购团队。我们通过独立承包商网络代表我们从美国汽车经销商处采购汽车。截至2022年和2021 12月31日,我们分别与342名和300名采购代理积极合作。

我们相信,我们对市场的专注和奉献,体现在我们采购代理团队的规模和成熟度,以及我们寻找和培训新采购代理的能力上,为我们提供了巨大的营销优势,使我们与竞争对手区别开来。尽管我们与许多其他向中国销售平行进口汽车的公司直接竞争,但我们的大多数竞争对手都是通过其在美国的家人或朋友获得美国汽车的小型家族企业,因此无法保证稳定的供应。我们开发了一个标准化的招聘、培训和管理大量专业采购代理的系统,使我们能够定期向中国市场销售大量汽车。由于采购代理是兼职的,并且是以佣金为基础支付的,高流动率对我们来说是一个特别的挑战,因为代理可能会在没有事先通知的情况下随时辞职。尽管如此,我们新开发的转介计划为现有代理商提供转介佣金,为他们转介给我们的新代理商成功完成的每笔交易提供转介服务,我们目前能够维持足够的采购代理来满足我们的采购需求。因此,我们已成为平行进口汽车的可靠来源,并与多家美国和中国平行进口汽车经销商建立了长期关系,这对我们的销售增长做出了重大贡献。截至2022年和2021 12月31日,我们的活跃客户群分别为17家和8家经销商。具体而言,我们在2022年有8个美国客户和9个中国客户,2021在美国和中国各有4个客户。截至2022年和2021 12月31日,我们分别向中国平行进口汽车经销商销售了434辆和167辆平行进口汽车。同期,我们分别向美国国内客户销售了29辆和220辆平行进口汽车。

财务数据:

据悉我们的收入成本从2021的3620万美元增加到2022年的5070万美元,增加了1450万美元,增幅40.0%,主要是因为我们的销售额增长。一般来说,从2021到2022年,我们同一型号或品牌的采购成本增加了,价格通常上涨3%至18%,而在同一时期,我们每辆车的平均售价上涨了约17.6%。我们预计,未来单车的采购成本将继续增加,主要是由于价格水平上升、芯片短缺、,以及制造商的产量减少。截至2022年和2021 12月31日,收入成本占总收入的比例分别为91.9%和92.3%。2022年成本收入比下降的主要原因是我们控制得很好的履行费用,特别是由于我们自己的员工完成了更多的采购,而对第三方顾问的依赖减少了。

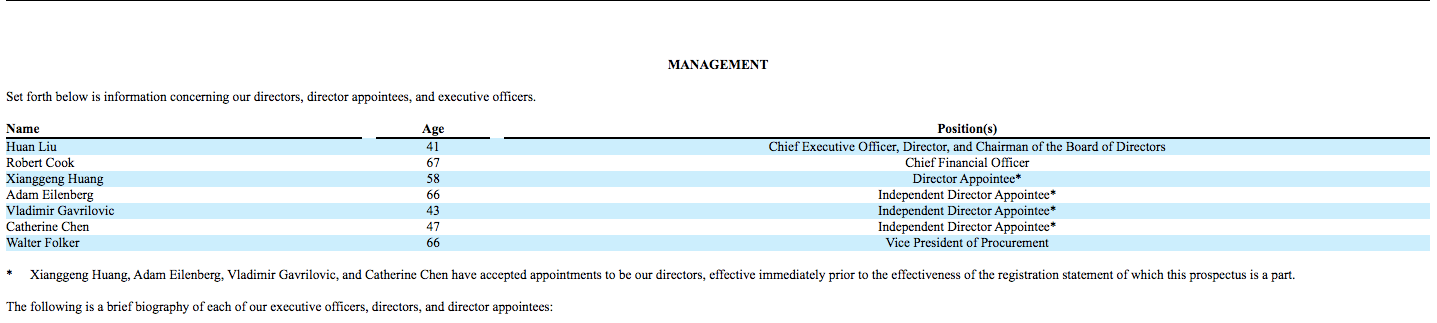

MANAGEMENT(主要管理者)

Set forth below is information concerning our directors, director appointees, and executive officers.

Mr. Huan Liu has served as our Chief Executive Officer and our Chairman of the Board of Directors since August 2016, and he has extensive experience in real estate, private equity, and car imports and exports. As the founder and CEO of Cheetah Net, Mr. Liu has been responsible for the management of day-to-day operations and high-level strategizing and business planning, as well as implementing proposed plans and evaluating the success of our Company in achieving its objectives. From 2014 to 2015, Mr. Liu served as the chief executive officer at Beijing Xinyongjia Technology Co., where he was responsible for identifying opportunities for expansion and analyzing operations to identify areas in need of reorganization. From 2012 to 2013, Mr. Liu served as the senior investment manager at Beijing Wanze Investment Management Co. Ltd., and was responsible for developing and implementing risk-based asset allocation models and performance analytics. Mr. Liu received his master’s degree in Finance from the International Business School at Brandeis University in 2012, and his bachelor’s degree in Finance and Law from Harbin Engineer University in 2005.

Mr. Robert Cook has served as our Chief Financial Officer since October 2022. He has extensive experience in corporate finance, SEC reporting, public accounting, investor relations, and corporate administration including management of internal controls. Mr. Cook is the founder and principal of RWC Consulting, LLC, a financial consulting company established in December 2016, where he is responsible for advising management and boards of directors of public and private companies on pre- and post-IPO financing opportunities. From June 2020 until April 2021, Mr. Cook served as the chief financial officer and corporate secretary of RenovaCare, Inc. (OTC: RCAR), where he was responsible for all financial functions, investor and public relations, and corporate administration including his duties as corporate secretary, From February 2017 to February 2020, Mr. Cook served as the chief financial officer at CorMedix Inc. (Nasdaq: CRMD) and was in charge of the company’s overall financial management, investor and public relations, and business development. From January 2016 to June 2016, Mr. Cook served as the chief financial officer at BioBlast Pharma Ltd. (Nasdaq: ORPN), where he was responsible for all financial functions, investor relations, and corporate administration. Mr. Cook also served as the chief financial officer at several other Nasdaq-listed companies, including Strata Skin Science Inc. (Nasdaq: SSKN) from April 2014 to January 2016, Immune Pharmaceuticals Inc. (Nasdaq: IMNP) from August 2013 to April 2014 and its predecessor EpiCept Corporation from April 2004 until August 2013, including one year as the company’s interim chief executive officer, and Pharmos Corporation (Nasdaq: PARS) from December 1997 to April 2004, respectively. Mr. Cook received his bachelor’s degree in International Finance from Kogod School of Business of the American University in 1977.

Mr. Xianggeng Huang will serve as our director starting immediately prior to the effectiveness of our registration statement of which this prospectus is a part. From 2003 to 2022, Mr. Huang served as the chairman of the board of directors of Fuzhou Yisheng Mechanical and Electrical Equipment Co., Ltd., where he was responsible for running the board of directors, consulting the executives on issues, challenges, and opportunities facing the company, and high-level strategizing and business planning. From 1999 to 2002, Mr. Huang served as a general manager of the Fujian branch of Kone Elevator Co., Ltd., a Finish elevator manufacturer. From 1997 to 1999, he served as a major project manager at Otis Elevator China Co., Ltd. Mr. Huang received his bachelor’s degree in Automated Machinery from Nanjing University of Science and Technology in 1984

文章版权归融e邦平台http://www.bangyantv.com所有,转载请务必注明出处并保留链接。

查看更多投融资讯,关注更多优质项目:下载融e邦金服app和关注融e邦金服微信(ID:rongebang88)

关注融e邦,做有智慧的投资人

温馨提示:众筹有风险,投资需谨慎

以上内容转载自网络,仅为信息传播之需,不作为投资参考,众筹有风险,投资需谨慎。