融e邦:旭航集团“SUNH”在美国证监会递交招股书,拟纳斯达克IPO上市

牵手融e邦,资本运作很简单。近日,杭州旭航网络科技有限公司的控股公司Xuhang Holdings Ltd(以下简称:旭航集团)在美国证监会公开披露招股书,拟在美国纳斯达克上市,其股票代码为“SUNH”。 其于2022年9月28日在SEC秘密递交招股书。

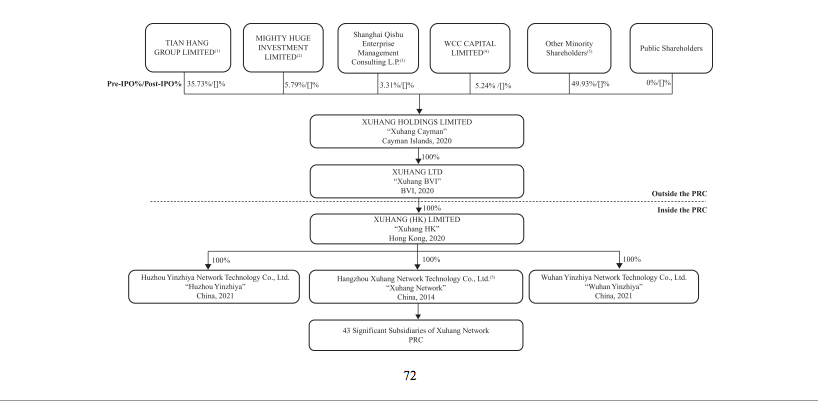

据悉Xuhang Holdings Ltd(以下简称:旭航集团)是一家在开曼群岛注册成立的控股公司,而不是一家中国运营公司。作为一家控股公司,我们没有自己的重大业务,我们的所有业务主要通过我们在中国的子公司进行。

根据招股说明书了解我们的公司结构:

查询其招股书了解到:我们在中国的子公司是内容驱动的营销服务提供商,在广泛的分销渠道中提供一套综合营销解决方案,主要关注新媒体内容营销。利用我们中国子公司在内容生产和运营方面的专业知识、广泛的分销渠道和跨平台的新媒体客户群,我们的中国子公司旨在为客户提供高效有效的综合营销解决方案,以满足他们在新媒体时代的营销需求。客户利用我们中国子公司的营销服务,通过多个渠道实现品牌和营销目标,主要关注微信公众号、微博、小红书、头条、抖音、快手和百度百家号等自媒体平台。截至2022年10月31日,我们在中国的子公司已经发布了短视频和广告,总浏览量超过1560亿次;我们在中国的子公司的新媒体账户群包括524个自营账户和491个合作账户,总计拥有约2.07亿互联网粉丝。我们中国子公司的客户包括大型互联网平台公司和城市生活各个领域的中小型本地企业,包括餐饮、娱乐和旅游。截至2020年12月31日、2021和2022年9月30日,我们的中国子公司的营销人员基数分别为656人、810人和867人。

目前,我们在中国的子公司提供两类营销服务:(i)新媒体综合内容营销服务,该服务依赖于创建和分发相关、吸引人和有价值的内容,以吸引和留住观众来推广品牌和销售产品和服务;(ii)数字广告服务,其强调需要选择与目标受众更匹配的广告分销渠道,以最大限度地提高营销效果。

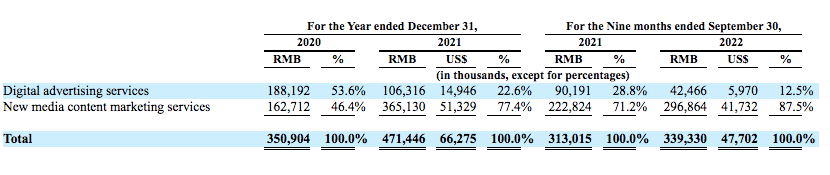

根据招股说明书了解到:运营结果下表列出了我们选定的合并损益数据,包括绝对金额和总收入的百分比。这些信息应与我们的合并财务报表和本招股说明书其他部分的相关注释一起阅读。任何时期的经营成果都不一定代表未来任何时期的预期成果。

根据招股说明书了解到:收入代表我们在数字广告服务和新媒体综合内容营销服务中为客户提供的服务。下表列出了我们在所示期间按类别划分的收入明细,包括绝对金额和占每个类别总收入的百分比:

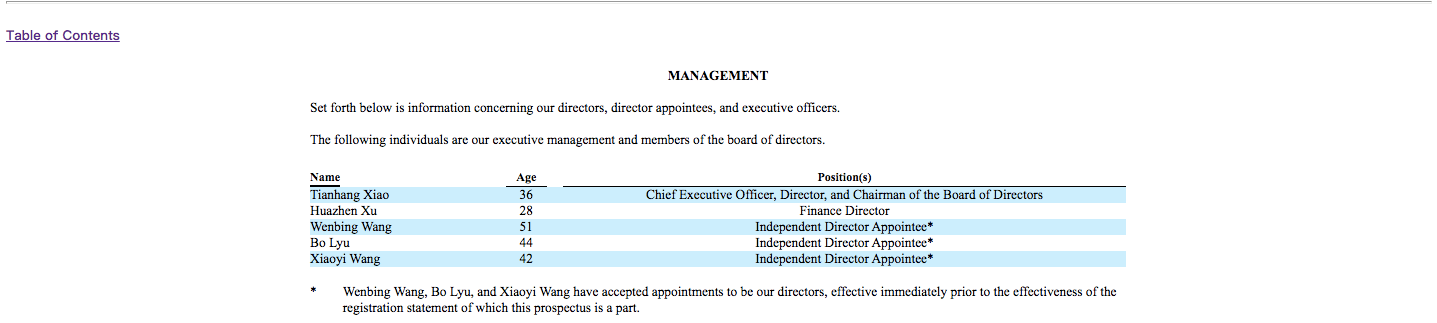

根据招股说明书了解到以下是关于我们的董事、董事任命人员和执行官的信息。以下人员是我们的执行管理层和董事会成员:

Mr. Tianhang Xiao has served as our Chairman of the Board of Directors since February 2023, Chief Executive Officer since September 2022, and director since June 2020. As the founder of Xuhang Network, Mr. Xiao has served as the chairman of the board of directors and general manager since September 2014, responsible for the management of day-to-day operations and high-level strategizing and business planning. Mr. Xiao has extensive experience in mobile Internet marketing, particularly in product development and technical analysis. From June 2010 to December 2011, Mr. Xiao served as a senior product manager at Sky-mobi Limited (formerly Nasdaq: MOBI), which is a mobile application store operator and was the first Chinese Internet marketing company listed on Nasdaq and was taken private in 2017 through a merger agreement with Amber Shining Investment Limited and Power Rich Limited. From January 2012 to August 2014, Mr. Xiao co-founded and served as the chief operating officer at Hangzhou Zhenqu Network Technology Co., Ltd., a company specializing in mobile advertisement placement and game services, which was subsequently acquired in 2015 by Meisheng Cultural and Creative Co., Ltd, a company listed on China’s Shenzhen Stock Exchange (SZ: 002699). Mr. Xiao received his bachelor’s degree in Weapon Systems and Engineering from Nanjing University of Science and Technology in 2010.

Mr. Huazhen Xu has served as our Finance Director since February 2023, and he is responsible for our overall financial management, including financial planning, accounting, and tax compliance. Mr. Xu has approximately eight years of experience in the financial and accounting fields. From April 2020 to May 2022, Mr. Xu served as a financial controller at Ebang International Holdings Inc. (Nasdaq: EBON), a company specializing in blockchain technology and cryptocurrency mining hardware. From October 2016 to August 2019, Mr. Xu served as a senior auditor at Ernst & Young LLP, where he oversaw and executed complex audit assessments while leading multiple audit engagements. Mr. Xu received his bachelor’s degree in International Accounting from Shanghai University of Finance and Economics in 2016. Mr. Xu has been a member of the Association of Chartered Certified Accountants since February 2020.

Mr. Wenbing Wang will serve as our independent director starting immediately prior to the effectiveness of the registration statement of which this prospectus is a part. As an independent director of IT Tech Packaging Inc. (NYSE: ITP) since October 2009, Mr. Wang has extensive experience and knowledge of finance and corporate governance practices, which would be particularly valuable in his role as a board member of our Company. Since June 2021, Mr. Wang has served as the chief financial officer of Phoenix Motor, Inc. (Nasdaq: PEV), a U.S.-based electric vehicle manufacturer that designs and produces electric trucks and buses, where he is responsible for the company’s overall financial management, including accounting, budgeting, and financial reporting. From November 2020 to June 2021, Mr. Wang served as the senior vice president of finance of SPI Energy Co., Ltd (Nasdaq: SPI) and the interim chief financial officer of Phoenix Motor, Inc. From February 2017 to November 2020, Mr. Wang served as the chief executive officer of Redwood Group International, a Hong Kong-based merchant bank focused on Greater-China growth and venture opportunities. Between December 2005 and October 2016, Mr. Wang served in various capacities at Fushi Copperweld, Inc. (formerly Nasdaq: FSIN)

文章版权归融e邦平台http://www.bangyantv.com所有,转载请务必注明出处并保留链接。

查看更多投融资讯,关注更多优质项目:下载融e邦金服app和关注融e邦金服微信(ID:rongebang88)

关注融e邦,做有智慧的投资人

温馨提示:众筹有风险,投资需谨慎

以上内容转载自网络,仅为信息传播之需,不作为投资参考,众筹有风险,投资需谨慎。