融e邦:中国“AI TRANSPORTATION ACQUISITION”成立SPAC正式向美SEC递交纳斯达克上市招股书

据悉AI TRANSPORTATION ACQUISITION CORP是一家新成立的空白支票公司,作为开曼群岛豁免公司成立,目的是与一个或多个企业或实体进行合并、股份交换、资产收购、股份购买、重组或类似的业务合并,我们在本招股说明书中将其称为我们的初始业务合并。我们没有选择任何潜在的企业合并目标,我们也没有,也没有任何代表我们的人,就与我们的初始企业合并直接或间接地与任何潜在企业合并目标发起任何实质性讨论。

虽然我们可能会在任何行业、部门或地理位置寻找目标,但我们打算专注于交通领域的目标业务,包括但不限于物流、新能源汽车、智能停车、车载芯片和人工智能算法、汽车服务和智能交通的相关领域。人工智能正在几乎所有行业塑造人类的未来;它已经是大数据、机器人和物联网(即物联网)等新兴技术的主要驱动力,我们相信在可预见的未来,它将继续作为技术创新者。我们寻求利用人工智能识别、收购和运营智能交通业务,这可能会为具有吸引力的风险调整回报提供机会,并特别关注与这些行业相一致的机会。全球人口增长和全球生活水平的持续提高,特别是在发展中国家,预计将通过人工智能和人工智能驱动的商业和个人技术,推动智能交通需求的持续增长。

我们打算通过我们的管理团队的广泛网络,包括汽车和汽车相关行业的企业主、公共和私营公司高管和董事会成员、投资银行家、私募股权和债务投资者、高净值家庭及其顾问、商业银行家、律师、管理顾问,会计师和其他交易中介机构。我们相信,这种方法,以及我们的管理团队在汽车和汽车相关行业内完成各种子部门收购的公认记录,将为推动股东创造价值提供有意义的机会。

这是我们证券的首次公开发行。每个单位的发行价为10.00美元,包括一股普通股、四分之三的可赎回认股权证和一项权利,该权利使持有人有权在完成我们的首次业务合并时获得十分之一(1/10)的一股普通股票,可根据本招股说明书进行调整。每份完整认股权证的持有人有权以每股11.50美元的价格购买一股普通股,并可根据本文所述进行调整。只有完整的认股权证可以行使。在单位分离时,不会发行部分认股权证,只有完整的认股权证才会交易。认股权证将在公司完成首次企业合并后30天内行使,并将在首次企业合并完成后五年或赎回或清算后提前到期,如本招股说明书所述。承销商有权自本招股说明书发布之日起45天内额外购买750000套股票,以弥补超额配售(如有)。

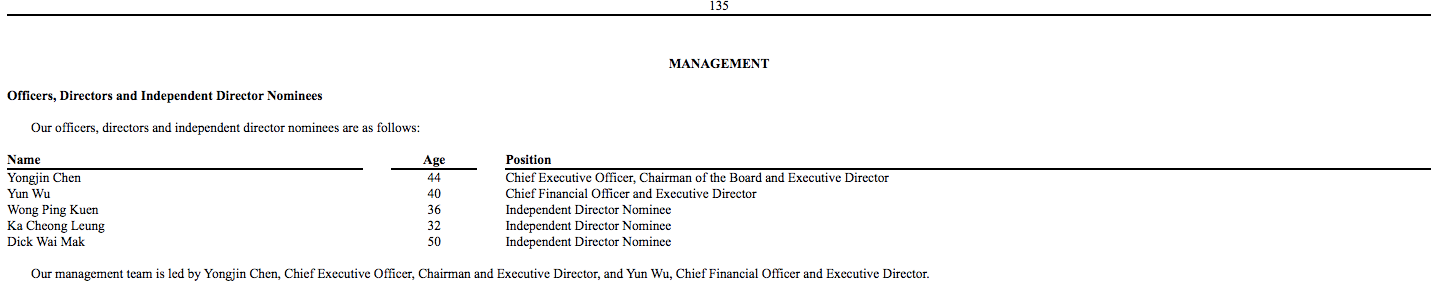

MANAGEMENT(管理)

Officers, Directors and Independent Director Nominees/Our officers, directors and independent director nominees are as follows:

管、董事和独立董事提名人我们的高管、董事和独立董事提名人如下:

Yongjin Chen, Chief Executive Officer, Chairman and Executive Director. Mr. Chen resides in Beijing, China, and brings more than two decades of experience in finance and technology. He is currently a partner at UniTHU Capital (Beijing) Investment Management Co., Ltd, where he has served since July 2017. At UniTHU Capital, Mr. Chen has worked with investors in the technology space. Prior to that, Mr. Chen was a founding partner responsible for fundraising, investment management and other aspects of funds at Beijing D&S Capital Management Co., Ltd, where he served from February 2014 to July 2017. From November 2015 to December 2016, Mr. Chen was the CEO of Beijing Heima Financial and a Managing Partner at the Beijing Heima Fund. From November 2014 to November 2015, he was an Executive Director at Yajie Angel Investment Management (Beijing) Co., Ltd. Mr. Chen started his career as the founder and general manager of HanYu Century (Beijing) Information Technology Co., Ltd. where he developed and operated a web-based virtual community called “Giant Bubble” from January 2007 to November 2014.

Mr. Chen holds a Bachelor’s Degree from Tsinghua University’s School of Mechanical Engineering (2000), an MBA from Peking University’s Guanghua School of Management (2015) and a Master’s Degree from Peking University’s Guanghua School of Management (2022).

Yun Wu, Chief Financial Officer and Executive Director. Ms. Wu resides in Beijing, China and brings more than two decades of experience in finance, e-commerce and technology companies. She is currently an accounting supervisor at UniTHU United (Beijing) Investment Management Co., Ltd., where she has served since April 2018 establishing and improving the company’s accounting management and financial management system, preparing and summarizing financial statements and working with audits. At UniTHU, Ms. Wu has also undertaken the due diligence review of government guide funds and has formulated tax financial plans for the company. Prior to that, she was a general ledger accountant at Beijing Dong Qiu Di Technology Co., Ltd. from August 2015 to April 2018, where she was responsible for the financial processing of the e-commerce department, amongst other duties.

At Beijing Dong, Ms. Wu also handled and maintained financial aspects of the business including high-tech management and subsequent maintenance and annual audits and tax settlements of domestic and foreign companies. From March 2015 to July 2015, Ms. Wu was a finance supervisor at Beijing Tiantian Fresh Technology Co., Ltd. and from March 2010 to February 2015, she was a finance supervisor at Reisi Interactive (Beijing) Consulting Co., Ltd. At Beijing Tiantian, Ms. Wu was responsible for improving the company’s financial system and sales performance rules, daily business transaction contracts, and daily accounting treatment, among other obligations. At Reisi Interactive, Ms. Wu was responsible for the daily tax work of the company, outsourcing project financial analysis and preparing annual, quarterly and monthly cash flow budgets, among other obligations.

Ms. Wu holds a Bachelor’s Degree from Nanjing University (2006) and various accounting certificates, including an intermediate accounting qualification certificate (2022), a fund qualification certificate (2018), an accounting primary qualification certificate (2013) and an accounting professional qualification certificate (2012).

文章版权归融e邦平台http://www.bangyantv.com所有,转载请务必注明出处并保留链接。

查看更多投融资讯,关注更多优质项目:下载融e邦金服app和关注融e邦金服微信(ID:rongebang88)

关注融e邦,做有智慧的投资人

温馨提示:众筹有风险,投资需谨慎

以上内容转载自网络,仅为信息传播之需,不作为投资参考,众筹有风险,投资需谨慎。